39+ mortgage qualification based on income

If youre not sure how much monthly mortgage Principal and Interest payment to enter you can generate this number using our standard mortgage calculator. Many factors affect what size mortgage you can afford including your credit profile interest rate loan type and length.

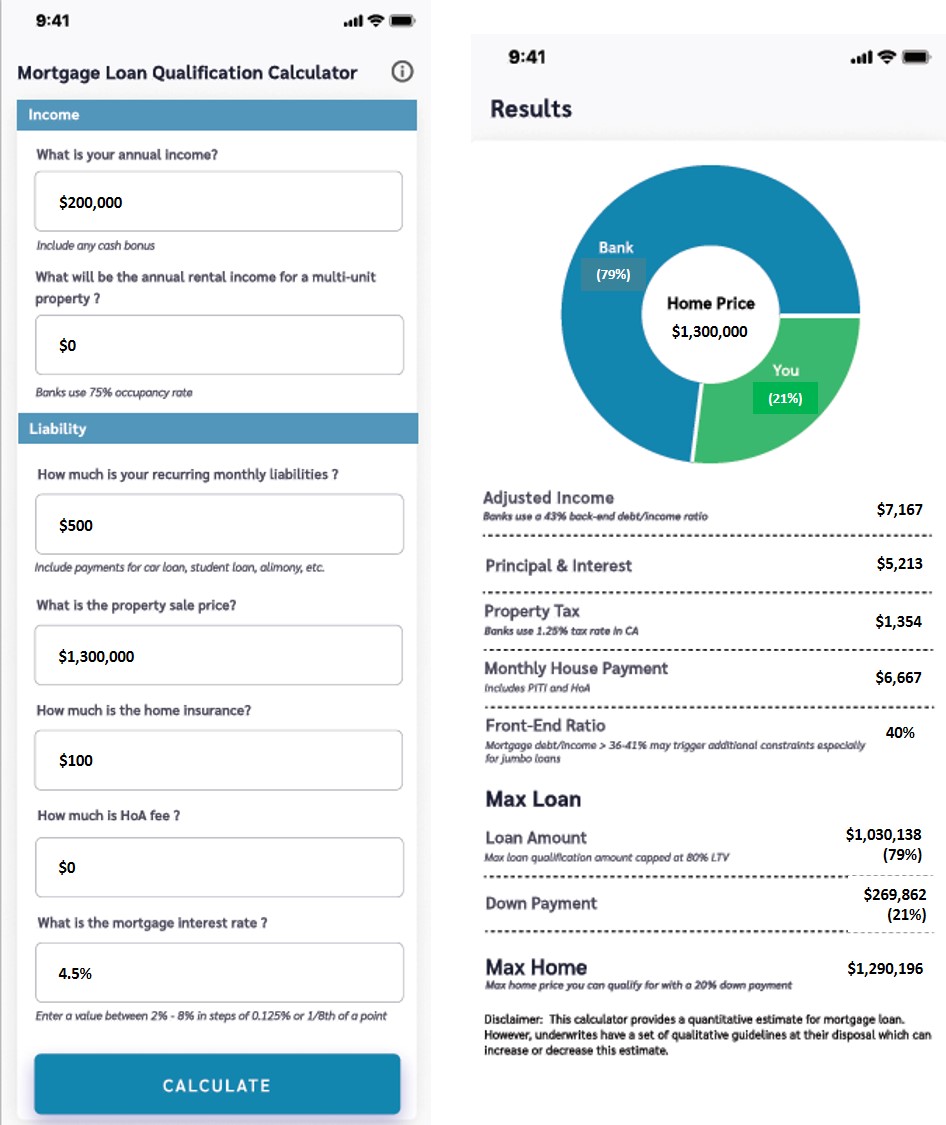

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

You may qualify for a loan amount of 252720 and your total monthly mortgage payment will be 1587.

. Web Fannie Maes HomeReady loan requires only 3 down and you may be able to count income from a boarder or roommate which could lower your DTI and help you qualify for a larger mortgage loan. Web If youre self-employed or work as a freelancer you might qualify for a mortgage if you have tax returns that reflect self-employment earnings for the last 12 months. Web Factor in income taxes and more to better understand your ideal loan amount.

Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36. This means you have to pay for private mortgage insurance PMI. Borrowers with low debt-to-income ratios have a good chance of qualifying for low mortgage rates.

Web Typically lenders cap the mortgage at 28 percent of your monthly income. Skip to Main Content. You dont need income to qualify there is no monthly mortgage payment and youre only responsible for monthly property taxes and insurance payments on your.

The calculator will then reply with an income value with which you compare your current. Web You can gauge how much of a mortgage loan you may qualify for based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments.

Calculate how much house you can afford with our home affordability calculator. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and your total monthly debt including your anticipated monthly mortgage payment and other debts such as car or student loan payments should be no more than 43 of your pre-tax. Since your cash on hand is 55000 thats less than 20 of the homes price.

Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well. Under traditional debt-to-income DTI ratios the income. Web It might help you to determine if you can qualify for a refinance especially if your income is lower since you originally got your mortgage.

Of course the lower your debt-to-income ratio the better. Web To get preapproved most lenders require applicants to provide copies of their pay stubs to establish current income bank account numbers and recent bank statements W-2 statements and both. Some loan programs place more emphasis on the back-end ratio than the front-end ratio.

Web The 2941 rule is important to know when thinking about your mortgage qualification because DTI helps lenders determine your ability to pay your mortgage. Web Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross household income.

Web If youre at least 62 years old and have at least 50 equity in your home you may convert that equity to income in various ways with a reverse mortgage. Although higher housing expense and DTI ratios are allowed under many loan types including conventional FHA USDA and VA loans the 2941 rule provides a good. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for your maximum monthly mortgage payment.

In that case NerdWallet recommends an annual pretax income of at least 184656 although you may qualify. Web Use our Mortgage Qualification Calculator to determine what size mortgage you qualify for based on your monthly gross income and debt expenses. This rule is based on your debt service ratios.

VA borrowers need to prove they earn stable income that covers not only their mortgage and other monthly debt but also living expenses based on their familys size the loan size the region of the country they live in and the expected maintenance expenses on the home. Web If youd put 10 down on a 555555 home your mortgage would be about 500000. Mortgage lenders want potential clients to be using roughly a third of their income to pay.

Web This calculator helps you estimate how much home you can afford. Web If you plan to use investment income for mortgage qualification lenders will want to see at least two years maybe three years worth of income tax returns. The VA calculates how much extra money is.

Simply enter your monthly income expenses and expected interest rate to get your estimate. Web Mortgage lenders and other financial institutions such as banks use your gross monthly income to determine whether or not you qualify for a home loan and can afford a monthly mortgage payment.

Loan Proposal 13 Examples Format Pdf Examples

Affordability Calculator How Much House Can I Afford Zillow

Mortgage Qualifying With Part Time Income And Other Income

What Income Can Be Used To Qualify For A Mortgage My Perfect Mortgage

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

What Counts As Income For A Mortgage Loan 2023 Guide

Mortgage Loan Qualification For Different Home Types Fincrafters

What Sources Of Income Count Toward Mortgage Qualification

Mortgage Qualifying With Part Time Income And Other Income

What Types Of Other Income In Mortgage Qualification Can Be Used

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

What Percentage Of Debt Should A Company Have Quora

Low Income Mortgage Loans For 2023

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

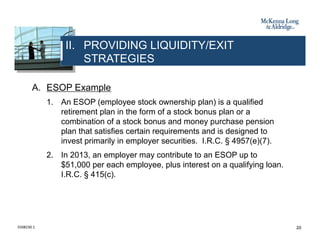

Business Succession Planning And Exit Strategies For The Closely Held

Interventions Designed To Improve Financial Capability A Systematic Review Birkenmaier 2022 Campbell Systematic Reviews Wiley Online Library